Does Health Insurance Cover Erectile Dysfunction Treatments?

When asking “Does insurance cover erectile dysfunction?”, the answer depends on various factors, including the treatment type, the underlying cause of ED, and your insurance plan. Insurance is more likely to cover FDA-approved medications like Viagra and Cialis when they are prescribed for a medically necessary reason, such as when ED is linked to underlying conditions like diabetes or heart disease. However, treatments like penile implants, shockwave therapy, and vacuum devices often face restrictions and may only be covered if deemed essential by your doctor. Understanding your plan’s specifics and having the right medical documentation can improve your chances of coverage.

Whether it’s a temporary challenge or a chronic problem, the impact of ED can feel confusing. Is it happening with you? There is no need to overthink because there’s a range of treatments available, from well-known medications like Viagra and Cialis to advanced options like penile implants and newer therapies. However, navigating insurance coverage for these treatments can feel like a maze. Will your plan cover it? What factors play into the decision? Does the cause of your ED matter?

The truth is, there’s no one-size-fits-all answer, and the process can be more complicated than it seems. In this guide, we’ll break down everything you need to know about how insurance handles ED treatments—from what’s covered (and what might not be) to how you can improve your chances of approval. Understanding your options and how to approach insurance companies can make all the difference when it comes to getting the care you need. Let’s dive in and demystify the complex world of ED treatment coverage.

Understanding Erectile Dysfunction and Why Coverage Matters

Erectile dysfunction (ED) is the inability to achieve or maintain an erection firm enough for sexual intercourse, and it can occur occasionally or persist over time.

This condition affects men of all ages and often leads to frustration, anxiety, and relationship issues. More than just a personal problem, ED is a medical condition that can signal underlying health concerns.

Common causes include physical factors such as atherosclerosis [1], which restricts blood flow to the penis, and conditions like diabetes, cardiovascular or heart diseases, and high blood pressure that impact circulation.

Psychological factors, including stress, anxiety, depression, and relationship issues, can also contribute, along with hormonal imbalances, particularly low testosterone. If you’re experiencing ED symptoms, it’s important to see a healthcare professional for a comprehensive evaluation.

Blood tests, medical history, and assessments like the IIEF-5 (International Index of Erectile Function) [2] help determine the root cause, assess the severity, and establish the medical necessity of treatment, which can be crucial for insurance coverage.

Why Insurance Coverage for ED Is Complex

Insurance coverage for erectile dysfunction is complicated. It varies based on treatment type, your insurance plan, and what causes your ED. Some treatments get approved easily, while others face rejection. Many policies exclude ED treatments when they see it as a lifestyle issue rather than a medical condition.

For insurance to pay for treatment, it must be medically necessary. This means the treatment is essential for diagnosing and managing your condition. If ED links to underlying conditions like diabetes, cardiovascular diseases, heart diseases, or prostate cancer, insurance is more likely to cover them. When ED has no underlying medical condition, insurers often view treatments as lifestyle interventions. Most commercial insurance companies will not cover ED medications or devices unless a doctor proves medical necessity.

FDA-approved medications like Viagra (sildenafil), Cialis (tadalafil), and Levitra (vardenafil) have better coverage chances.

While many insurance plans will cover FDA-approved ED medications like Viagra, other treatments such as penile implants or shock wave therapy are often considered experimental and may not be covered.”

These PDE5 inhibitors passed rigorous testing and are widely recognized as effective. For many insurance plans, FDA approval is key to determining coverage.

Commercial Health Insurance and ED Coverage

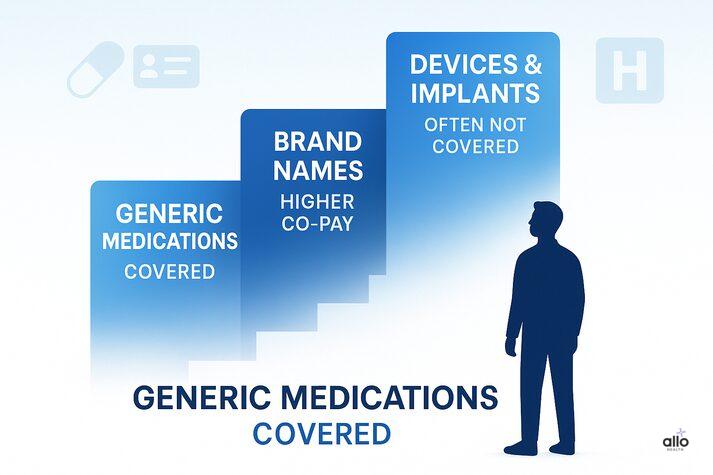

Commercial health insurance plans have formularies, which are lists of approved medications. ED medications like PDE5 inhibitors often sit in higher tiers, meaning higher co-pays.

Understanding your deductibles, co-pays, and formulary is essential for managing treatment costs. Many major insurers cover ED medications under Prescription Drug Plans.

Coverage specifics vary by plan. Some cover only generic medications like sildenafil, while others include treatments for underlying conditions. Insurance plans may exclude ED treatments they consider non-essential.

Vacuum erection devices and penile prosthesis might not be covered, especially if viewed as elective. However, inflatable penile prosthesis and other surgical implants may be approved when medically necessary.

Coverage for Common ED Treatments

1. Oral Medications (PDE5 Inhibitors)

- PDE5 inhibitors like Viagra and Cialis are commonly covered by insurance when prescribed for medical reasons.

- These are first-line treatments for ED and have the best coverage rates. Generic versions typically cost less than brand names.

2. Injectable and Urethral Medications

- Injectable treatments like intracavernosal injections and urethral medications may be covered by some insurance plans.

- These options are more expensive and typically require prior authorization. Your doctor must document that oral medications were ineffective first.

3. Vacuum Erection Devices

- Vacuum erection devices are often not covered because insurers see them as non-medically necessary.

- Some plans might cover them for specific conditions after other treatments fail. These devices help improve blood flow to achieve an erection.

4. Penile Prosthesis and Surgical Implants

- Penile prosthesis, which are surgical implants for severe ED cases, may be covered if medically necessary.

- This typically happens after other medical treatments have failed. Inflatable penile prosthesis and malleable implants are the two main types.

- Prior authorization is almost always required, and patient satisfaction rates are generally high with these surgical techniques.

5. Emerging Therapies

- Newer therapies like shock wave therapy, low-intensity shockwave therapy, and extracorporeal shock wave therapy usually lack insurance coverage. Insurers consider them experimental.

- Other treatments like penile traction therapy, stem cell treatments, and hormone therapy also rarely receive coverage.

Understanding the Insurance Process

Many insurance plans require prior authorization before covering certain ED treatments. This applies especially to medications or expensive procedures like a penile prosthesis. Your doctor submits documentation to prove medical necessity and treatment history. Having the right documentation improves approval chances. This includes your doctor’s notes, medical history, blood test results, and proof that other treatments failed.

If your ED treatment gets denied, you can appeal. Understanding why it was denied and gathering additional supporting documentation can improve your success rate. Work with your doctor to strengthen your appeal with detailed medical records and hormone levels testing results.

Conclusion

If erectile dysfunction relates to an underlying condition like diabetes or cardiovascular diseases, insurance is more likely to cover ED treatment. Insurers view it as part of a broader health plan. This approach treats ED as a symptom of a larger medical issue rather than an isolated lifestyle concern. Treating underlying conditions often improves erectile function naturally. Blood tests checking hormone levels help identify these connections. Your doctor can document this link to improve coverage chances

"The following blog article provides general information and insights on various topics. However, it is important to note that the information presented is not intended as professional advice in any specific field or area. The content of this blog is for general educational and informational purposes only.

Book consultation

The content should not be interpreted as endorsement, recommendation, or guarantee of any product, service, or information mentioned. Readers are solely responsible for the decisions and actions they take based on the information provided in this blog. It is essential to exercise individual judgment, critical thinking, and personal responsibility when applying or implementing any information or suggestions discussed in the blog."